Building an Automated Forex Trading Strategy from Scratch

Today, any trader can create a sophisticated automated trading strategy, also known as an Expert Advisor (EA). This EA can trade without any human intervention on platforms such as MetaTrader 4, MetaTrader 5, TradeStation, or NinjaTrader. Below are some important facts and tips regarding the development of automated strategies.

Introduction to Automated-Strategy Building

What is an Automated Trading Strategy?

An automated trading strategy is a software-based code that integrates with a trading platform, allowing traders to automatically execute, modify, and close trading orders based on a predefined set of rules.

There are two general approaches to building an automated trading strategy:

(i) Model-based approach

(ii) Data-driven approach

The data-driven approach involves big data and requires significant hardware resources. Retail traders are advised to focus solely on model-based trading strategies, which are easier to implement.

Eight (8) Basic Automated Trading Strategies

These are some popular automated trading strategies:

(1) Trend-Following Strategies (tracking strong price trends)

(2) Breakout-Trading Strategies (initiating positions when key price breakouts are confirmed)

(3) Volatility-Expansion Strategies (targeting changes in volatility and combining results with price metrics)

(4) Mean-Reversion Strategies (based on the idea that the price of a financial asset will revert to its mean approximately 80% of the time)

(5) News-Events Automated Strategies (triggering trades based on the discrepancy between actual data and market expectations)

(6) Market Sentiment Automated Strategies

(7) Arbitrage & Statistical Arbitrage Automated Strategies

(8) Mathematical-Model-Based Strategies

How Does an Automated Trading Strategy Work?

An automated strategy incorporates several algorithms and two core mechanisms:

(a) The analysis mechanism, which monitors financial data 24/5 and generates alerts primarily based on technical analysis.

(b) The execution mechanism, which can open, modify, and close trading positions at any time.

In terms of money management, these strategies may include advanced algorithms that dynamically adjust position sizing according to current market conditions (volatility, spread, etc.).

What Are the Advantages of Using an Automated Trading Strategy?

Here are some key reasons to automate a manual trading strategy:

(1) Achieving 100% rule-based Forex trading

An automated strategy can continuously monitor the currency market and execute trades only when specific rules and conditions are met.

(2) Trading 24/5 without physical or emotional limitations

An automated trading strategy does not get tired and is unaffected by emotions.

(3) Saving valuable time

Implementing an automated strategy saves time by automating key processes such as market analysis, filtering, decision-making, and trade execution.

(4) Backtesting any trading idea within minutes and with high precision

Manual backtesting is difficult and time-consuming, but with automation, you can quickly and accurately test any trading idea. This allows you to select the best-performing strategy based on measurable results and optimize it for different market conditions.

(5) Earning money by selling a custom-made automated strategy

Although selling a successful trading strategy requires promotion and support, you can list your strategy on a marketplace and outsource promotion and payment handling.

Creating Trade Setups and Determining Specific Trading Rules

To build a successful trading strategy, you must first develop detailed trade setups. These setups are the result of hard work and extensive backtesting, and they define the specific market conditions under which trades will be executed. These conditions should cover all market types (ranging, bullish, and bearish). Here are some common tools used to create setups:

-

Fibonacci retracements (used for trading market corrections)

-

Key support/resistance breakouts

-

Order/volume breakouts

-

MACD crossovers

-

RSI-based setups

-

Intermarket correlation setups

Creating an Efficient Money Management System and Inserting Key Filters

Money management is the most underestimated aspect of financial trading. The risk settings of an automated trading strategy play a crucial role in its overall success. Key components of an effective money management module include:

-

Spread-control filter (to manage trading during volatile market conditions)

-

Risk/reward filters (selecting only trades with a favorable risk/reward ratio)

-

Lot sizing and trade leverage (critical for risk control)

-

Max drawdown filter (limiting the impact of losing streaks)

-

Market gaps filter

-

Time filters (to avoid trading during major news events)

-

Debug filter (to detect and monitor errors after the strategy goes live)

Trading Orders:

-

Stop-loss orders (to limit potential losses on any trade)

-

Trailing stop orders (to lock in profits while allowing trades to run)

How to Create an Advanced Automated Trading Strategy Without Programming Skills

For those who want to implement an automated trading strategy but lack programming skills, there are online tools available that can convert trading ideas into fully automated strategies.

For those who want to implement an automated trading strategy but lack programming skills, there are online tools available that can convert trading ideas into fully automated strategies.

EA Builder for Creating Auto-Trading Systems

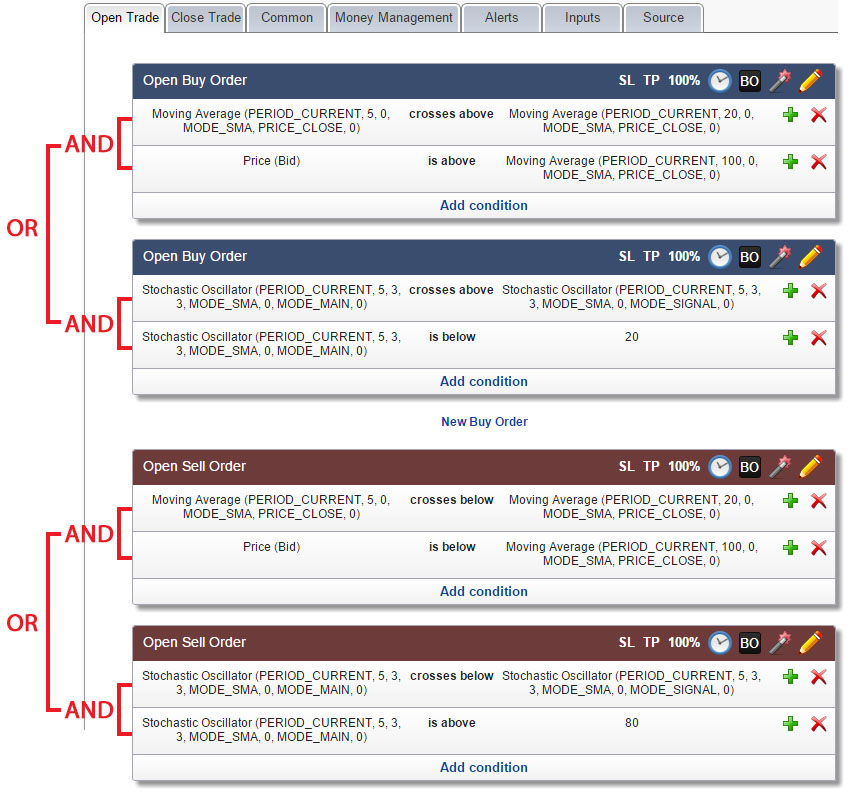

One of the best online tools currently available is EA Builder. It offers a graphical interface for building strategies and exports fully executable MQL files for MetaTrader 4 and MetaTrader 5. EA Builder also supports the TradeStation platform.

-

Completely free for creating indicators; a one-time fee of $97 allows unlimited creation and export of automated strategies as MQL files

-

Includes a full set of functions (including trendlines)

-

Comprehensive money management features (including time filters)

-

100% online application (compatible with Windows, Mac, and Linux)

» Visit the EA Builder App Website

Advantages of Using EA Builder

-

Free to use for creating fully executable indicators

-

Fully graphical interface (no coding required)

-

Compatible with all financial assets and timeframes (Forex, Crypto, Stocks, Gold, etc.)

-

Multiple alert options (email, audio alerts, on-screen notifications)

-

Supports MetaTrader 4, MetaTrader 5, and TradeStation

-

Final executable code can be used on an unlimited number of accounts

You can start using EA Builder for free to create indicators and later upgrade to transform them into fully automated trading strategies. The full version is available for a one-time payment of $97.

» EA Builder for Creating Automated-Trading Strategies

Final Words – How to Test Your Automated Trading Strategy and Ensure It Works

Once you have finalized your automated strategy and converted it into an executable file (e.g., MQL4), you can begin backtesting. The most common way to backtest an automated strategy is by using the built-in Strategy Tester available in MetaTrader 4 or MetaTrader 5. After optimizing your strategy and achieving satisfactory results, you should test it on a demo account. If the demo performance meets your expectations, you can proceed to a live account. It is highly recommended to start with a micro-lot account before transitioning to a standard-lot live account.

-

Backtest and Optimize

-

Demo Account

-

Micro-Lot Account

-

Standard-Lot Account

□ Creating an Automated Forex Trading Strategy from Scratch

TradingFibonacci.com (c) -You are NOT allowed to copy, reproduce, display, or modify this article

▶️ FIND OUT MORE AT TRADINGFIBONACCI.COM