Using the Fibonacci Retracement Tool

Fibonacci retracement is the most widely used technical analysis tool based on Fibonacci ratios. It can be applied to any financial market (Forex, Equities, Bonds, or Commodities) and on any timeframe. However, it is best used when trading liquid assets and in timeframes longer than M30.

Short Explanation (Background) of the Fibonacci Retracement

When the price of a financial asset pulls back after an uptrend or downtrend, the retracement often follows a predictable mathematical relationship. Fibonacci retracement measures this relationship using Fibonacci ratios. The key levels used are 23.6%, 38.2%, 61.8%, and 78.6%, all derived from the Fibonacci sequence, along with the commonly included 50.0% level.

Core Applications in Trading

The horizontal lines (23.6%, 38.2%, 50.0%, 61.8%, 78.6%) of the Fibonacci retracement work as magnets for price action, highlighting zones where traders anticipate:

-

Potential Reversals: Back in the direction of the prior trend (most common expectation at 38.2%, 50%, 61.8%).

-

Potential Continuation of the Retracement: If shallower levels fail to hold.

-

Critical Breakdown/Breakout Levels: Especially the deep 78.6% level and the 100% level (prior swing point).

Success hinges on correctly identifying the swing points, understanding the relative strength of each level (with 61.8% being the most significant), and always confirming signals with price action and other technical tools. Phi provides the mathematical framework; market psychology and collective action determine the outcome at these levels.

The Key Fibonacci Ratios

Here is how the Fibonacci ratios are calculated:

- 61.8% (0.618): The Golden Ratio Inverse

The Fibonacci ratio of 61.8% is considered a key level, known as the "golden ratio" or the "golden mean." It is found by dividing one Fibonacci number by the next one. For example: 144 ÷ 233 = 0.618027.

- 38.2% (0.382): The Complementary Ratio

The Fibonacci ratio of 38.2% is the second most important and is found by dividing one Fibonacci number by the number two places to the right. For example: 144 ÷ 377 = 0.38196.

- 23.6% (0.236): The Shallow Retracement

The Fibonacci ratio of 23.6% is the third most important and is found by dividing one Fibonacci number by the number three places to the right. For example: 144 ÷ 610 = 0.23606.

- 50.0% (0.50): The Psychological Hinge.

The Fibonacci ratio of 78.6% is derived by subtracting 0.236 from 1.

The 78.6% Retracement Level – Why It Also Matters

The 78.6% level holds significance due to its mathematical connection to the golden ratio: it is the square root of 0.618, or √0.618, reinforcing its relevance within the Fibonacci framework.

-

Deep but Critical Retracement: This level marks a substantial pullback within a trend. When price holds at 78.6%, it often signals that the underlying trend still has strength and may resume.

-

Breakdown Signal: A decisive break beyond this level typically suggests the prevailing trend is weakening or exhausted—at least in the short term.

-

Strategic Uses: Counter-trend entries and stop-loss placement

How the Fibonacci Retracement Works

The Fibonacci retracement is applied by identifying two extreme points on a price chart: the peak and the bottom of a price move, which can occur in either an uptrend or a downtrend.

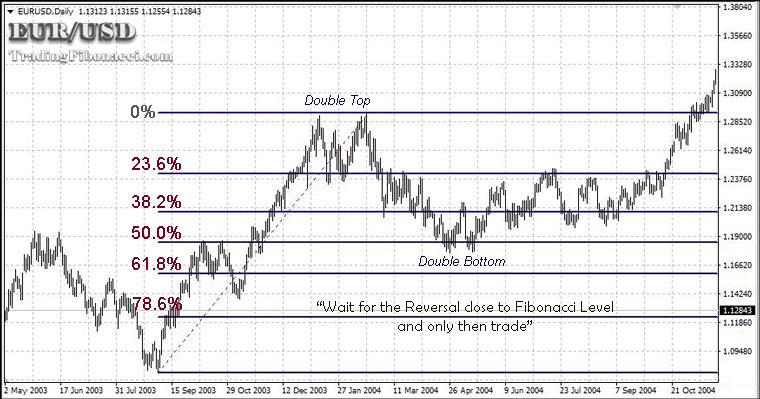

As previously mentioned, the key Fibonacci ratios are 23.6%, 38.2%, and 61.8%. The Fibonacci retracement tool also includes the 50.0% and 78.6% levels, making a total of five ratios: 23.6%, 38.2%, 50.0%, 61.8%, and 78.6%. When the tool is applied, these ratios are displayed as horizontal lines between the peak and the bottom. These five lines indicate potential support and resistance areas.

These levels help identify critical points where price reversals may occur. It's important to note that Fibonacci retracement levels should be viewed as zones or areas of support and resistance, rather than exact price points.

- In an uptrend, set the 0.0 level of the retracement tool at the wave low and the 100.0 level at the wave high.

- In a downtrend, set the 100.0 level at the wave high and the 0.0 level at the bottom.

If the price breaks through one Fibonacci level, it is likely to continue moving toward the next level.

The following chart illustrates how traders use Fibonacci retracement to identify potential support and resistance levels after an uptrend.

Chart: Using the Fibonacci retracement on EURUSD

Distinguishing Strong and Moderate Trends

In a strong trend, pullbacks typically reach only the 23.6% or 38.2% Fibonacci retracement levels. In more moderate trends, pullbacks often extend to the 50.0% or, more commonly, the 61.8% level.

Generally, extra importance should be given to the 38.2% and 61.8% retracement levels.

Placing Stop-Loss Orders

A key advantage of using Fibonacci retracement in trading is the ability to identify optimal stop-loss levels quickly. Once the price reverses near a Fibonacci level, place a stop-loss just below the local low (in an uptrend) or above the local high (in a downtrend).

Fibonacci Retracement Tool in Trading Platforms

The Fibonacci retracement tool is available in all modern trading platforms and can be applied with just a few clicks. To use the Fibonacci retracement tool in MetaTrader:

- Go to Menu > Insert > Fibonacci > Retracement

Basic Tips When Using The Fibonacci Retracement Tool

(1) Avoid using the Fibonacci retracement during major news releases or after significant fundamental events.

(2) Prefer applying the tool to highly liquid financial assets, such as Forex majors or major indices.

(3) Use the Fibonacci retracement on timeframes above M30, ideally on H4 and D1 charts.

(4) Treat Fibonacci levels as general support and resistance areas, not as precise price points.

(5) It’s better to wait for a price reversal near a Fibonacci level before entering a position.

(6) Give extra weight to the 38.2% and 61.8% levels, as these are the most significant retracement levels.

(7) You can apply multiple Fibonacci retracements on different waves and timeframes; they can complement one another.

(8) Always confirm signals from Fibonacci retracement with another tool, such as MACD. Use MACD on timeframes above M30, preferably H1 or H4.

Final Thoughts

If you ask an experienced trader about the Fibonacci retracement, responses will vary from enthusiastic to dismissive. As with many tools, the truth lies somewhere in between. The Fibonacci retracement can be effective when used selectively and carefully. Apply it to liquid assets, use it on higher timeframes, and confirm its signals with a reliable indicator. That’s all you need to do.

■ Using the Fibonacci Retracement Tool

George Protonotarios, Financial Analyst

TradingFibonacci.com (c)

▶️ FIND OUT MORE AT TRADINGFIBONACCI.COM