(+) Investing Tips

“Technical Analysis of Stock Trends” by John Magee and Robert D. Edwards is the first book to offer a solid methodology for analyzing the predictable behavior of financial markets. Here are some important insights we can gain from studying the book.

Technical Analysis and Charting

Prices reflect a wide range of variables.

Changes in the price of financial assets capture numerous fundamental factors and influences, including fear, greed, deceit, gullibility, brokers’ need for income, money managers’ need for performance, economic forecasts, monetary liquidity, manipulation, fraud, economic cycles and beliefs about them, public sentiment, and the persistent human desire to be right.

🎯Napoleon Hill’s 28 Timeless Success Principles

Napoleon Hill (October 26, 1883 – November 8, 1970) was an American journalist who spent two decades researching 500 successful individuals to develop an organized system of personal achievement. Among those he interviewed were Henry Ford, Alexander Graham Bell, Thomas Edison, and John D. Rockefeller.

💵 Warren Buffett's Short History

Warren Edward Buffett is an American Businessman, considered the most successful investor of the 20th century. Buffett is the primary shareholder of Berkshire Hathaway and was ranked as the world's wealthiest person in 2008.

🎯 Warren Buffett's Achievements

- Building Berkshire Hathaway into a $1 trillion giant. Berkshire Hathaway’s Class A shares skyrocketed from $19 in 1965 to over $740,000 per share today.

- Delivering an average annual return of roughly 20% over six decades.

- Buffett perfected the principles of intrinsic value and margin of safety.

- He popularized the “buy and hold” approach.

- Buffett capitalized on market downturns, famously investing $5 billion in Goldman Sachs during the 2008 financial crisis.

📈 Warren Buffett's Investment Advice & Tips

1. Buy only something that you'd be perfectly happy to hold if the market shut down for 10 years. If you don't feel comfortable owning something for 10 years, then don't own it for 10 minutes.

Jesse Livermore's 17 Trading Tips and 7 Rules

Jesse Livermore (1877–1940) was a famous American stock trader. He was also known as the ‘Boy Plunger’ and the ‘Great Bear of Wall Street’ for making a fortune by short-selling the market during the American stock market crashes of 1907 and 1929.

🎯 Jesse Livermore's Market Impact

The “Boy Plunger” Era

By the age of 20, his aggressive and highly speculative style had earned him over $100,000 in today’s terms—and the nickname "Boy Plunger."

1907 Market Crash: $1 Million in a Day

Anticipating the panic-driven sell-off, he took large short positions and profited as the market plummeted. In a single day, he earned $1 million (approximately $30 million today), exerting enough influence to push J.P. Morgan into orchestrating a banking system rescue.

1929 Wall Street Crash: $100 Million Payday

He methodically built short positions leading up to the infamous Black Tuesday. When the market collapsed, he reaped over $100 million in profits (equivalent to roughly $1.5 billion today), solidifying his reputation as the legendary "Great Bear of Wall Street."

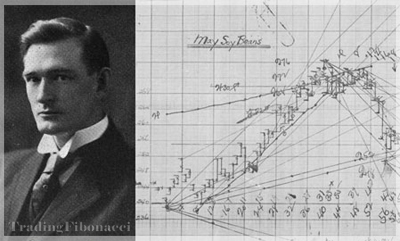

🎯William Delbert Gann Trading Rules

William Delbert Gann (1878–1955) was a renowned trader who introduced new technical analysis tools such as Gann angles and the Hexagon. His forecasting model is based mainly on geometry and mathematics, as well as astronomy. Gann introduced stock market angles in his work Basis of My Forecasting Method (1935). The most important stock market angle, according to Gann, is the 45° angle or 1x1, which represents one unit of price movement per one unit of time. William Delbert Gann is said to have gained 50 million USD during the Great Depression. In 1933 alone, he reportedly earned 4,000% on his capital, with 422 winning trades out of a total of 479.

Here are Gann’s pieces of advice for stock investors.

📉 Gann's 20 Rules for Successful Trading

1. Only trade active markets

Gann recommends only trading high-volume markets. An active market means liquidity, and liquidity means low transaction costs as the spread between ask/bid is getting tighter.

2. Avoid getting in and out of the market too often

Frequent trading leads to a high transaction cost.

Jeff Bezos Quotes and Business Advice

Jeffrey, or Jeff, Bezos is an American internet entrepreneur and investor born in 1964. He is the founder and CEO of Amazon.com. Under his leadership, Amazon became the largest retailer on the web and a model for internet-based sales.

1. "There are two kinds of companies, those that work to try to charge more and those that work to charge less. We will be the second.”

2. "We've had three big ideas at Amazon that we've stuck with for 18 years, and they're the reason we're successful: Put the customer first. Invent. And be patient."

3. "If you're competitor focused, you have to wait until there is a competitor doing something. Being customer-focused allows you to be more pioneering."

4. "I think frugality drives innovation, just like other constraints do. One of the only ways to get out of a tight box is to invent your way out."

5. "Part of company culture is path-dependent—it's the lessons you learn along the way."

6. "If you never want to be criticized, for goodness' sake don't do anything new."

Fibonacci Trading

Uncovering the hidden proportions underlying market behavior...

🎯 Explore Fibonacci trading tools and tutorials:

» Combining Fibonacci with S&R

» Combining Fibonacci with TAs

» MT4 MT5 Fibonacci Indicators

📌 Discover the Advice from Market Gurus:

📖 eBOOK: TRADING WORLD MARKETS USING PHI AND THE FIBONACCI NUMBERS {by G. Protonotarios}

A Guide to Fibonacci Trading with Insights from Elliott Waves, Gann Numbers, and Harmonic Patterns..

► ePub at Amazon | ► PDF Version

Online Forex Brokers

Compare Online Brokers for International Traders: » Compare ECN/STP Brokers

Trading Education

2025 Holidays

|

|

| Date | Holiday |

| Jan. 1, Wednesday, | New Year’s Day |

| Jan. 20, Monday | Martin Luther King |

| Feb. 17, Monday | Presidents' Day |

| April 18, Friday | Good Friday |

| May 26, Monday | Memorial Day |

| June 19, Thursday, | Juneteenth Day |

| July 4, Friday | Independence Day |

| Sept. 1, Monday | Labor Day |

| Nov. 27, Thursday | Thanksgiving Day |

| Dec. 25, Thursday | Christmas Day |

Chart Patterns

📊 Identify and Trade High-Probability Chart Patterns:

» Time Frames and Trading Styles

📈 Engaging in Global Market Trading