Tools

💻 Introduction to Trading Setups

A trade setup refers to a structured methodology that includes a specific set of criteria used to identify high-probability trading opportunities. These criteria may be based on technical analysis, fundamental analysis, or a combination of both. The following article outlines the basics of trading setups and provides examples, based on the book Trade Your Way to Financial Freedom by Van Tharp.

Trading Setups and Trading Systems

Many traders mistakenly equate trading setups with complete trading systems.

Trading setups are not full trading systems; they are only one component of a broader strategy. An effective trading system includes several additional elements.

Setups play a key role in identifying optimal entry points in the market.

However, setups alone should not be the sole reason for entering a trade. Rather, they are conditions that must be met before you even consider opening a position.

How to Use the Fibonacci Extensions Tool

The Fibonacci Extensions tool is a multi-timeframe trading instrument that can be applied to any financial market. Its unique value lies in its ability to indicate precise take-profit levels when an asset breaks an all-time high (ATH) and enters price discovery.

What Can the Fibonacci Extensions Show?

While the Fibonacci Retracement identifies potential retracement levels, Fibonacci Extensions reveal how far the price may rise following a retracement. This makes them particularly effective for identifying market tops when an asset enters price discovery. However, the tool is also applicable for spotting market bottoms.

Fibonacci Extensions calculate the impulse wave in the direction of the trend. The tool can be customized to display any desired levels, but the most commonly used ones are shown in the table below.

Table: Key Fibonacci levels

|

Key Fibonacci Levels |

|

|

0.2360 |

1.0000 |

|

0.3820 |

1.6180 |

|

0.5000 |

2.6180 |

|

0.6180 |

3.6180 |

|

0.7860 |

4.2360 |

Building an Automated Forex Trading Strategy from Scratch

Today, any trader can create a sophisticated automated trading strategy, also known as an Expert Advisor (EA). This EA can trade without any human intervention on platforms such as MetaTrader 4, MetaTrader 5, TradeStation, or NinjaTrader. Below are some important facts and tips regarding the development of automated strategies.

Introduction to Automated-Strategy Building

What is an Automated Trading Strategy?

An automated trading strategy is a software-based code that integrates with a trading platform, allowing traders to automatically execute, modify, and close trading orders based on a predefined set of rules.

There are two general approaches to building an automated trading strategy:

(i) Model-based approach

(ii) Data-driven approach

The data-driven approach involves big data and requires significant hardware resources. Retail traders are advised to focus solely on model-based trading strategies, which are easier to implement.

Eight (8) Basic Automated Trading Strategies

These are some popular automated trading strategies:

(1) Trend-Following Strategies (tracking strong price trends)

(2) Breakout-Trading Strategies (initiating positions when key price breakouts are confirmed)

(3) Volatility-Expansion Strategies (targeting changes in volatility and combining results with price metrics)

(4) Mean-Reversion Strategies (based on the idea that the price of a financial asset will revert to its mean approximately 80% of the time)

(5) News-Events Automated Strategies (triggering trades based on the discrepancy between actual data and market expectations)

(6) Market Sentiment Automated Strategies

(7) Arbitrage & Statistical Arbitrage Automated Strategies

(8) Mathematical-Model-Based Strategies

Trading Fibonacci MT4 Indicator -The FiboQuantum Review

What is it about? Fibo Quantum is an MT4 indicator based on the Fibonacci sequence and the Golden Mean.

Fibo Quantum is an advanced algorithm for MT4 that generates trading signals using Fibonacci numbers and ratios. The indicator precisely shows when to open and close trades to maximize profit. Additionally, Fibo Quantum guides you on where to set your Take-Profit and Stop-Loss levels. The indicator was developed by Karl Dittmann.

Fibo Quantum Features

These are some key features:

These are some key features:

□ Trades any Forex Pair in Multiple Timeframes (M15, M30, H1, H4, and D1)

□ Shows exact points for entering/exit (Includes Take-Profit and Stop-Loss levels)

□ Price Volatility Detection

□ Multiple Trading Styles and 3 different modes (Conservative, Normal, and Aggressive)

□ Never Re-Paints

□ Signal alerts sent via email, pop-up, and mobile push notifications

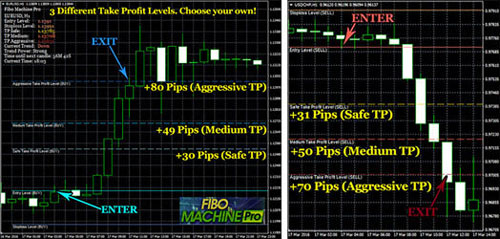

How to Use FiboQuantum

After adding FiboQuantum to MT4, the indicator automatically draws all levels on every chart where it is applied. These levels include Buy, Sell, three Take-Profit targets, and a Stop-Loss level. Once the asset’s price reaches the Entry level, you open the trade and place the suggested Stop-Loss. Then, choose one of the three recommended Take-Profit levels to set your exit. If the price hits the Take-Profit, you open the next trade when the price reaches a new Buy or Sell signal.

Fibonacci Trading

Uncovering the hidden proportions underlying market behavior...

🎯 Explore Fibonacci trading tools and tutorials:

» Combining Fibonacci with S&R

» Combining Fibonacci with TAs

» MT4 MT5 Fibonacci Indicators

📌 Discover the Advice from Market Gurus:

📖 eBOOK: TRADING WORLD MARKETS USING PHI AND THE FIBONACCI NUMBERS {by G. Protonotarios}

A Guide to Fibonacci Trading with Insights from Elliott Waves, Gann Numbers, and Harmonic Patterns..

► ePub at Amazon | ► PDF Version

Online Forex Brokers

Compare Online Brokers for International Traders: » Compare ECN/STP Brokers

Trading Education

Chart Patterns

📊 Identify and Trade High-Probability Chart Patterns:

» Time Frames and Trading Styles

📈 Engaging in Global Market Trading